Indicators on Employee Benefits You Should Know

Table of Contents3 Simple Techniques For Employee BenefitsEmployee Benefits Can Be Fun For Everyone9 Simple Techniques For Employee BenefitsGetting My Employee Benefits To WorkSome Known Incorrect Statements About Employee Benefits Facts About Employee Benefits RevealedWhat Does Employee Benefits Mean?8 Easy Facts About Employee Benefits DescribedEmployee Benefits Can Be Fun For Anyone

Allow's take a look at eight of them: This is a popular option among tech start-ups and also commonly component of larger corporations' pay bundles. Stock options provide an employee the right to purchase the firm's stock at an established cost - Employee Benefits. Typically, employees require to remain with a company for a certain duration of time prior to they can exercise this right, usually a year.If the firm has done well during this time, the stock might be worth dramatically more than what the staff member is paying for it.

The smart Trick of Employee Benefits That Nobody is Discussing

A great way to technique advantages plans is to have a broad variety of solutions that you can use. This allows you to craft certain bundles for each new hire that is a good fit for them.

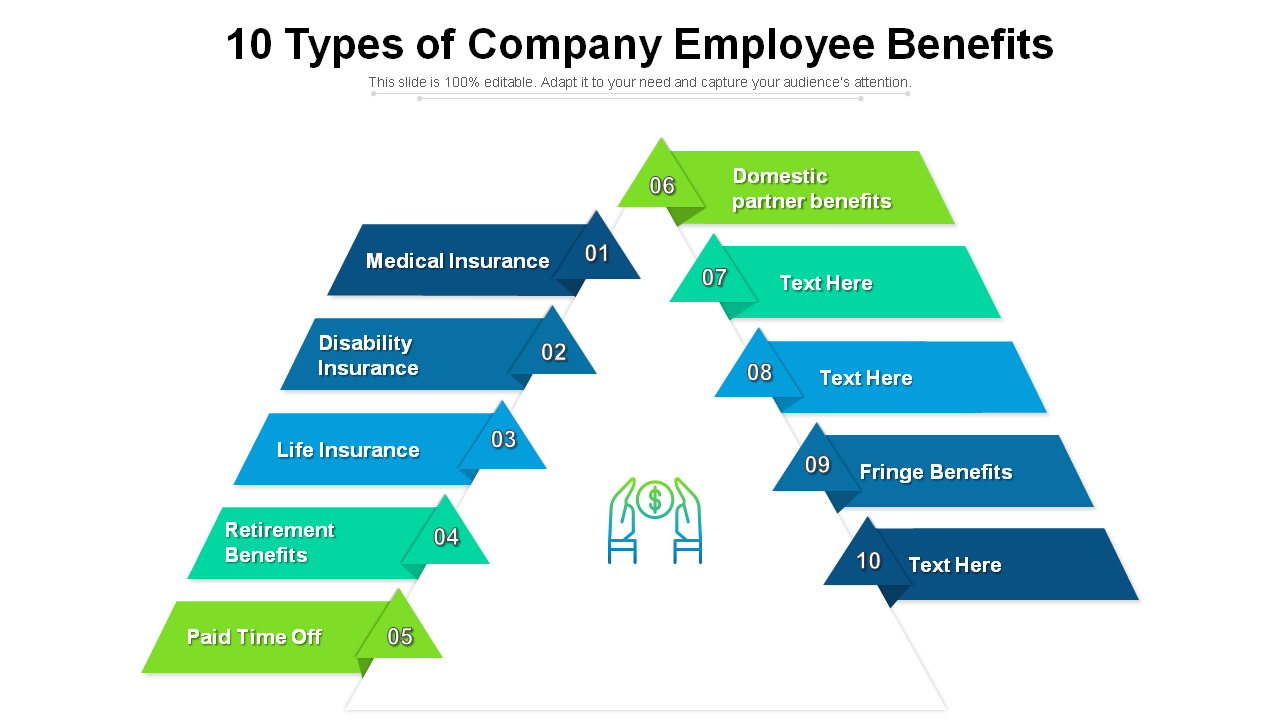

The small company employee benefits you can offer are countless. Benefits consist of typical benefits such as medical insurance and also unique benefits such as catered lunches. Employee advantages are a vital part of compensation. You want to offer the best benefits to attract as well as keep staff members. Exactly how do you know which advantages to use? Start by thinking about one of the most typical fringe benefit.

Employee Benefits Fundamentals Explained

Federal or state laws need you to offer some advantages. There are various other advantages that you can select to provide to employees. FICA is a combination of Social Safety and security and also Medicare taxes.

Workers' settlement repayments are utilized to pay for medical expenses as well as lost salaries (Employee Benefits).

See This Report about Employee Benefits

Regulations need some kinds of leave. You might need to give workers enough time off to elect.

An Unbiased View of Employee Benefits

Employee Benefits

If your organization has fewer than 50 workers, it still could be look at this now covered by state FMLA regulations. There are numerous optional benefits that you can supply. Below are the most usual staff member advantages you can pick to offer to staff members.

These are payroll-deduction Individual retirement a knockout post accounts, streamlined staff member plans (SEPs), and SIMPLE IRAs." When taking into consideration retired life strategies to use workers, you need to consider your costs, staff member expenses, ease of using the plan, and whether you will certainly contribute to retired life financial savings. You can establish volunteer benefits that workers totally pay for. Employee-pay-all benefits enable you to provide benefits at a reduced rate, yet at restricted or no price to your service.

The Best Strategy To Use For Employee Benefits

There are numerous kinds of optional leave that you can offer to employees. You can give trip and also authorized leave for employees to utilize for personal or wellness days. Even though you don't need to supply a paid time off policy, the majority of employers do. Different paid authorized leave laws by state may also need you to give repayment for unwell days.

And also, you might supply bereavement pause when a staff member's relative passes away. Some states have legislations that need you to give pause to employees. State laws might call for that you pay staff members for some kinds of time off. Do you offer flexible functioning hours to a lot of your permanent workers? Flexible functioning times let staff members work around their personal routines.

Some Ideas on Employee Benefits You Need To Know

You just have to pick a motivation and also objective that will function with your organization. You can use to workers the products or solutions that your service offers.

Start your complimentary trial currently! This post has been updated from its initial publication day of October 3, 2016.

Employee Benefits Things To Know Before You Get This

By: Taylor Stanton For numerous small companies, the battle to take on bigger companies for talent is an uphill battleparticularly when it comes to benefit offerings. While you recognize recruiting and retention is necessary, you may not be sure if the advantages you provide are a selling factor to your potential employees.

gov, a Flexible Investing Account (likewise referred to as an adaptable spending setup) is a special account staff members placed cash into that they use to Resources spend for certain out-of-pocket healthcare prices. Employees don't pay taxes on this cash, which means they conserve an amount equivalent to the taxes they would have paid accurate you allot.

Employee Benefits Can Be Fun For Everyone